Smart Info About How To Check Income Tax Refund Status

Amended returns and those sent by mail can take up to.

How to check income tax refund status. You cannot use check your refund status to view the status of a payment. If you filed your taxes early (good for you!) and have been wondering where your maryland tax refund is, you’re not alone. To use where’s my refund?

Your social security number (or individual taxpayer identification number),. Information is updated once a day, overnight. Other ways to check if your.

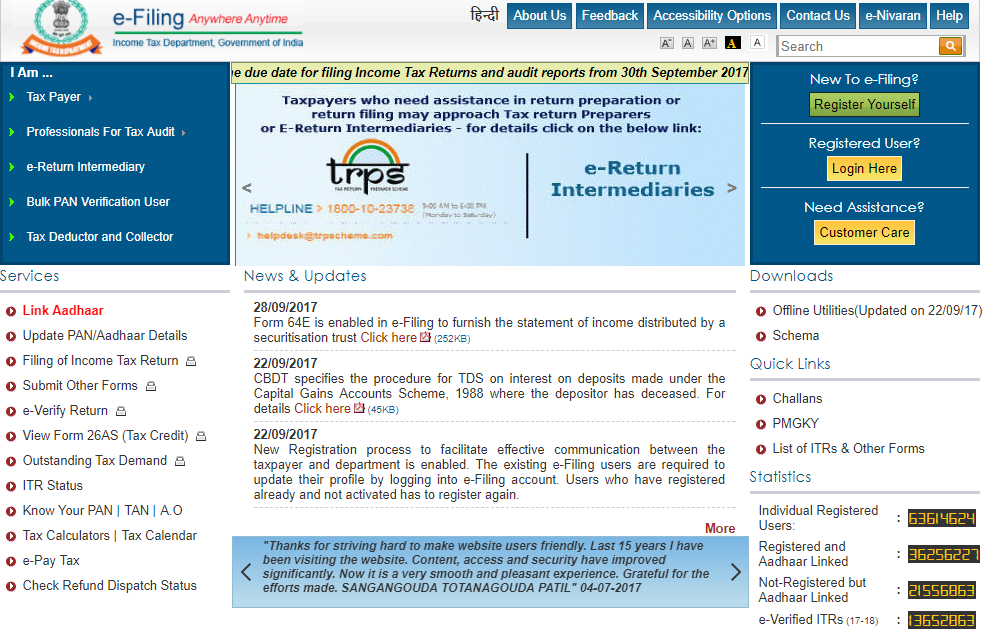

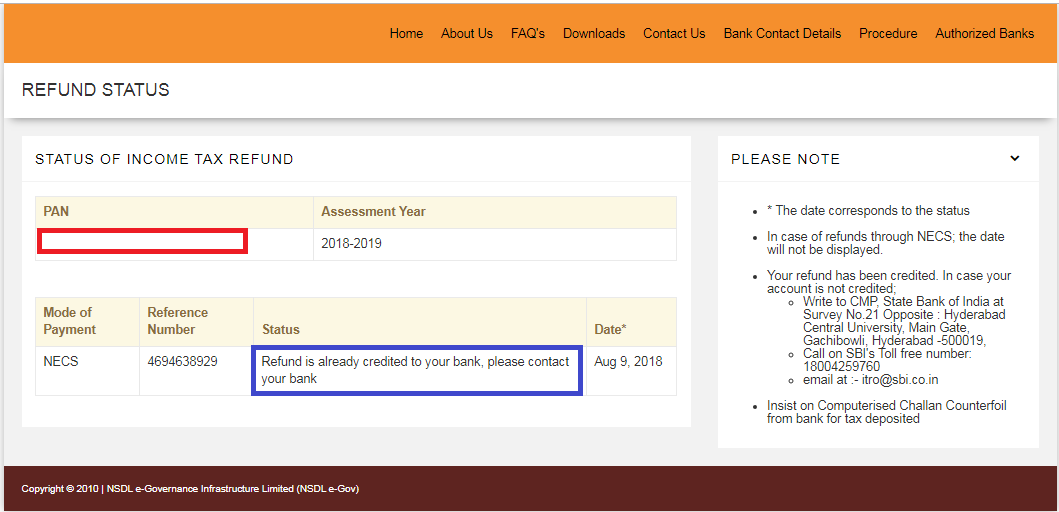

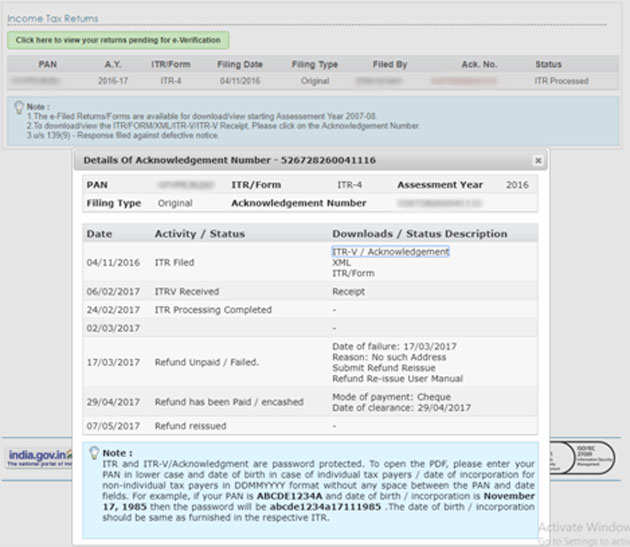

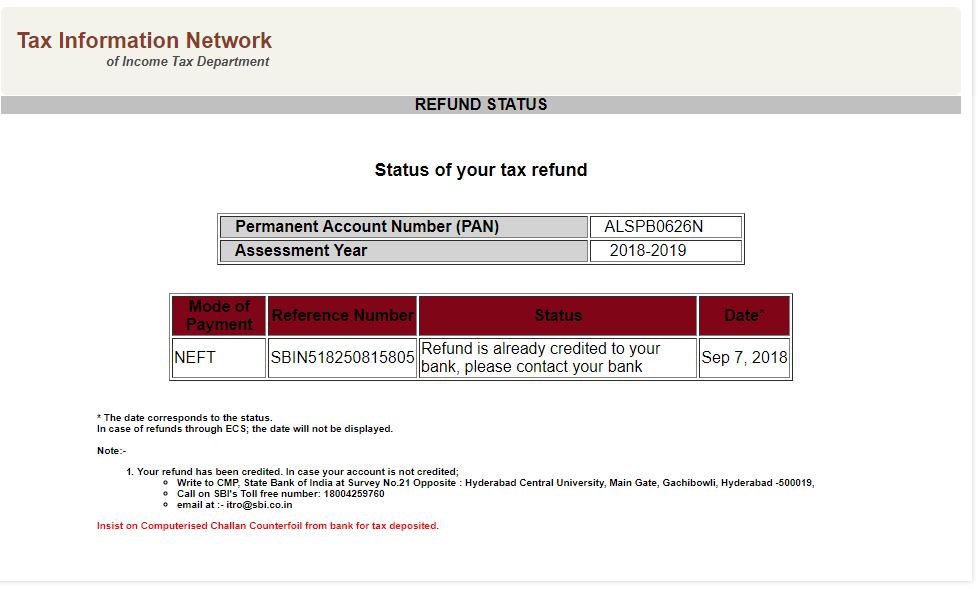

Checking your browser before accessing incometaxindia.gov.in this process is automatic. Enter your pan and assessment year. You can check your refund status using either of these methods:

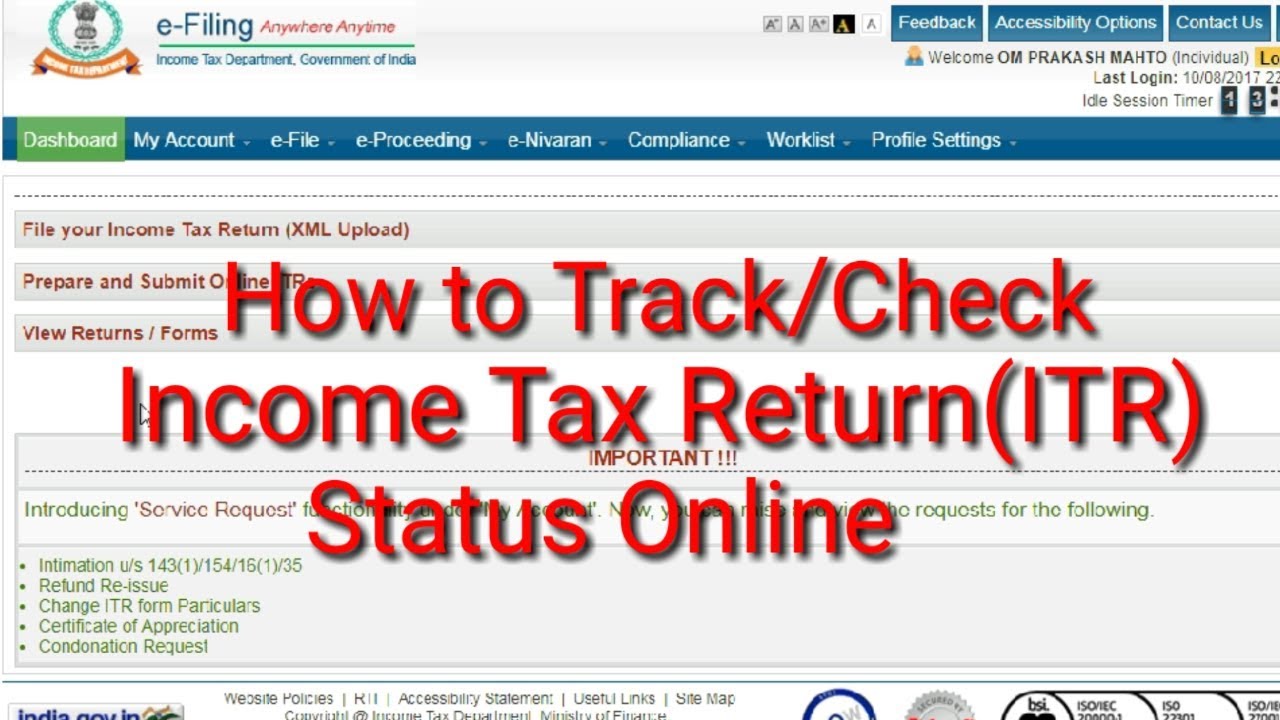

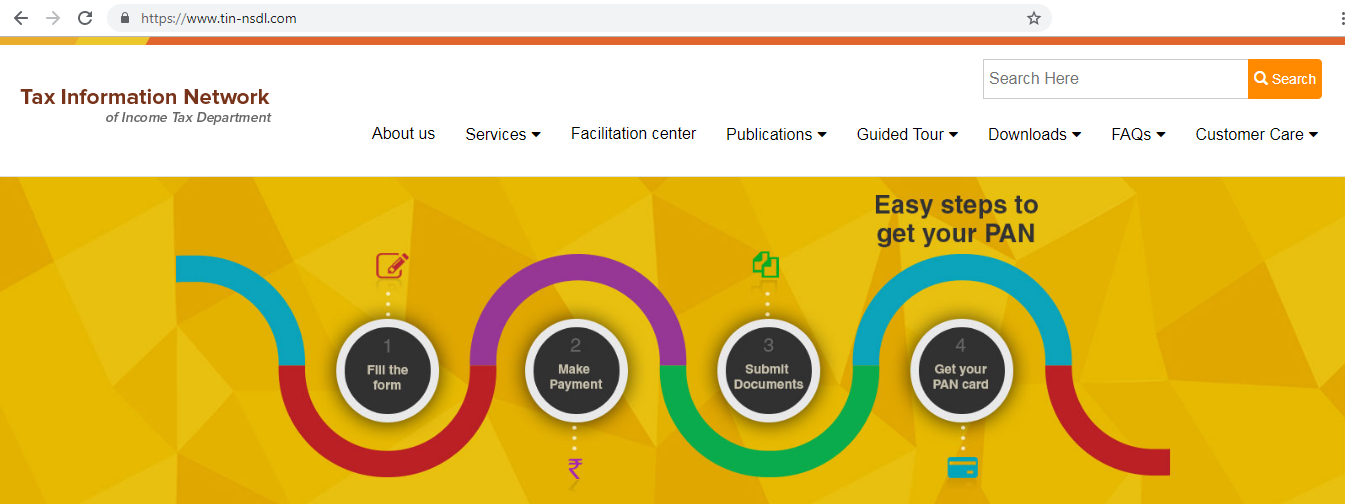

This is the fastest and easiest way to track your refund. Refund status check on tin nsdl portal. Method 1 visit the income tax official portal:

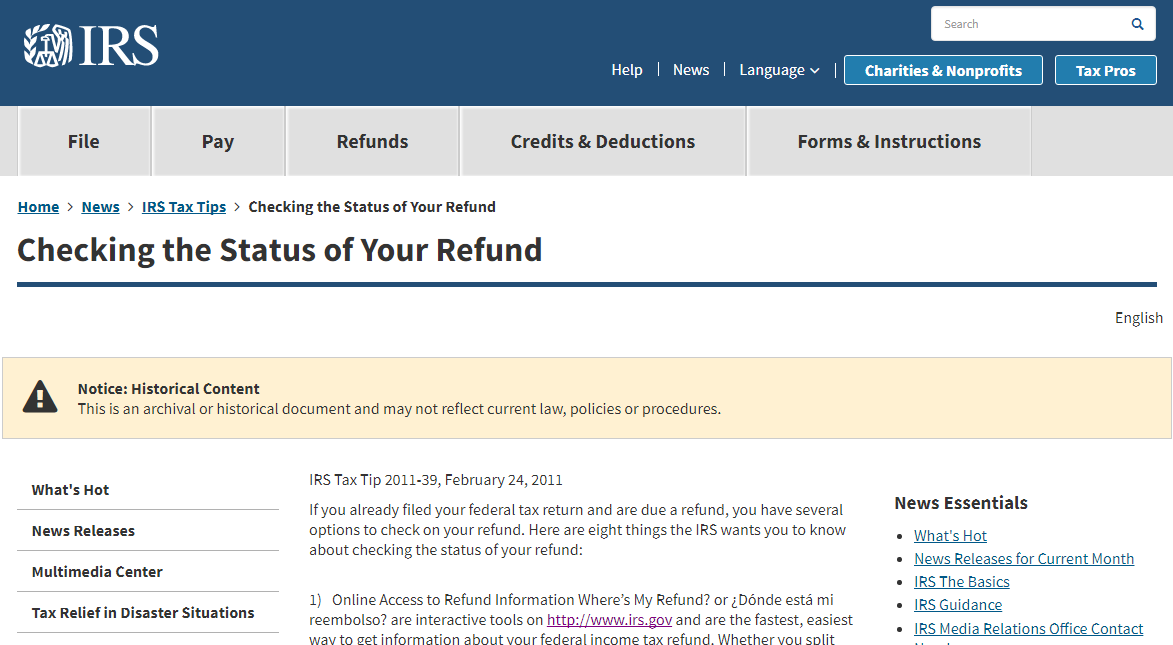

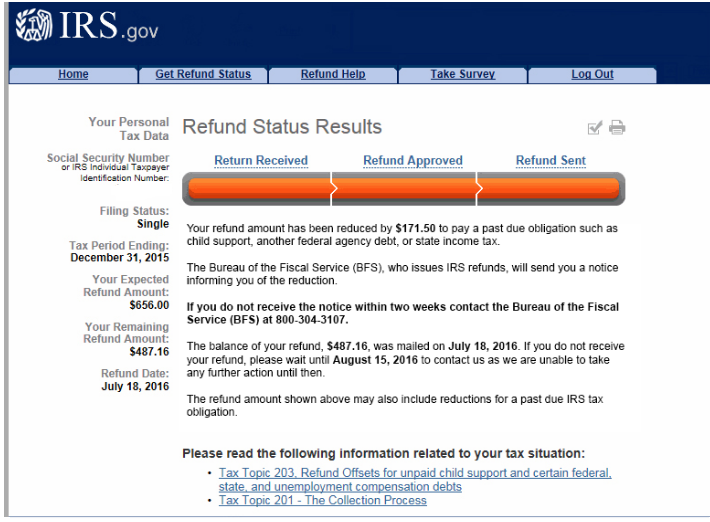

2/21/2024 4:00 p.m. Use this tool to find out what you. To use the irs' tracker tools, you'll need to provide your social security number or individual taxpayer identification number, your filing status (single, married or head.

To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting. There are three methods to check your income tax refund status: Your browser will redirect to requested content shortly.

To check on the status of your refund, you'll need to have three items prepared: Use the irs where's my refund tool or the irs2go mobile app to check your refund online. Information for individuals on tax refunds, refund interest, how to check your tax refund status, understand your refund and transfer your refund.

Your social security or individual taxpayer id number (itin) your filing status;. If you chose direct deposit, the money should land in your account within five days from the date the irs approves your refund. Check your refund.

Jan 22nd, 2024 | 12 min read contents [ show] the due date to file an itr return. Home money and tax income tax check how to claim a tax refund you may be able to get a tax refund (rebate) if you’ve paid too much tax. Enter the pan and select the relevant assessment year for which the status of the refund is to be checked, enter the captcha code and click on proceed.

See requested refund amount to learn where to find this amount.