Sensational Tips About How To Buy A Covered Call

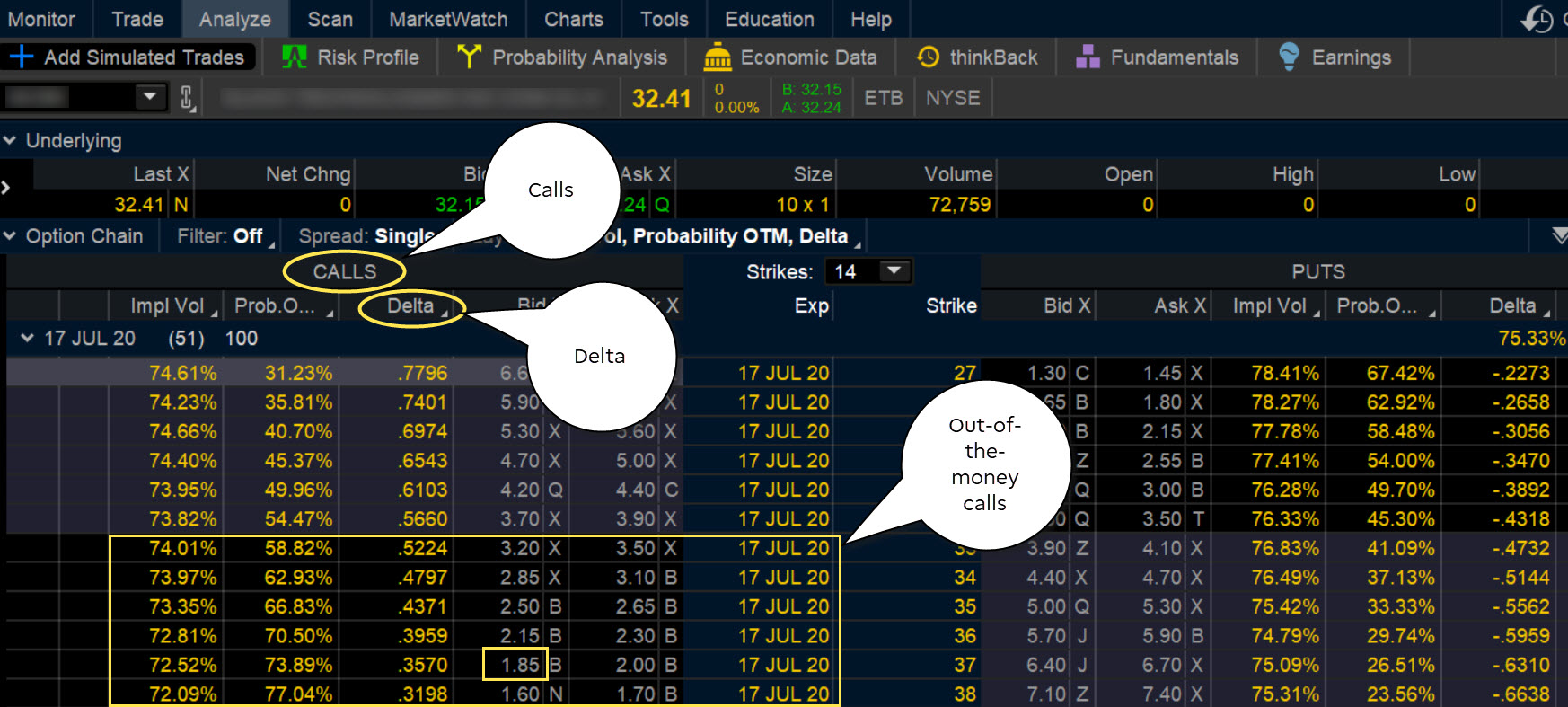

When an investor sells a call against existing shares, the order ticket only comprises a short call.

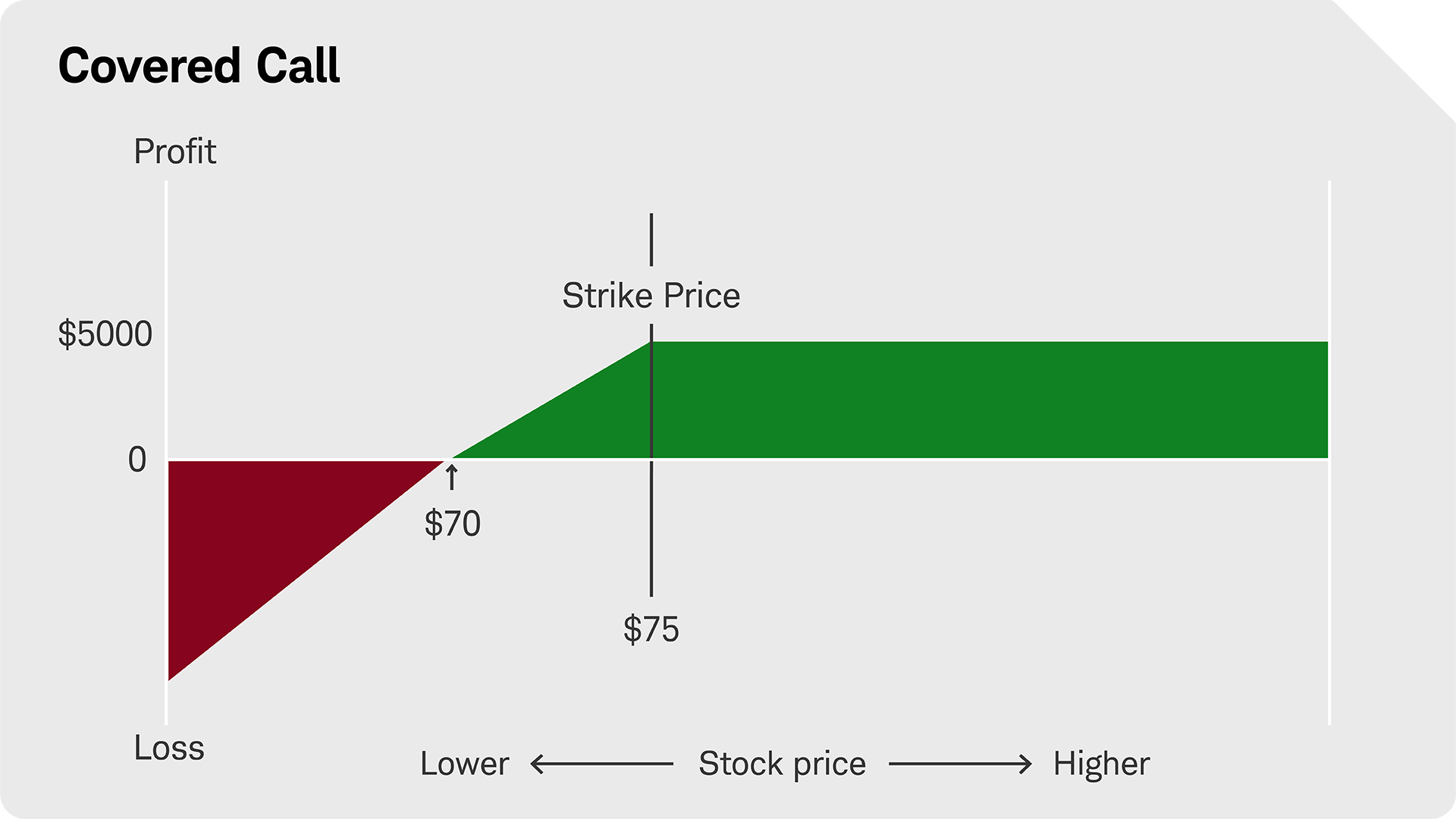

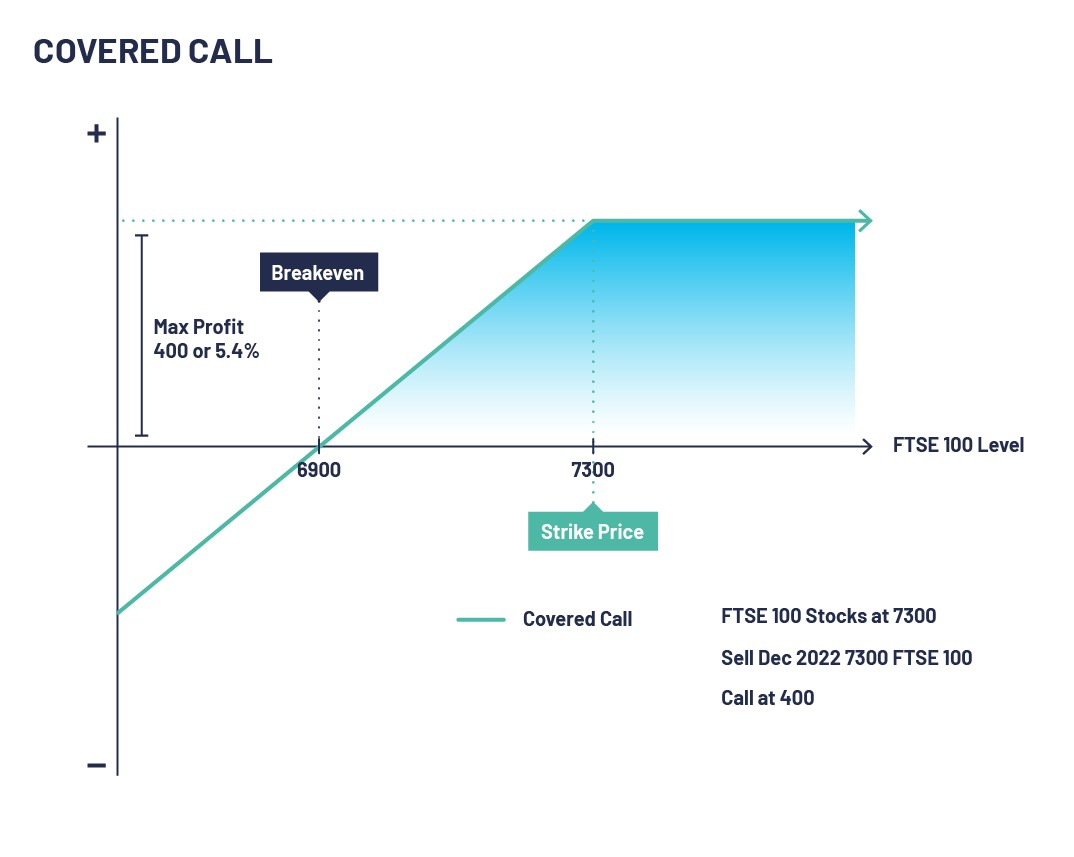

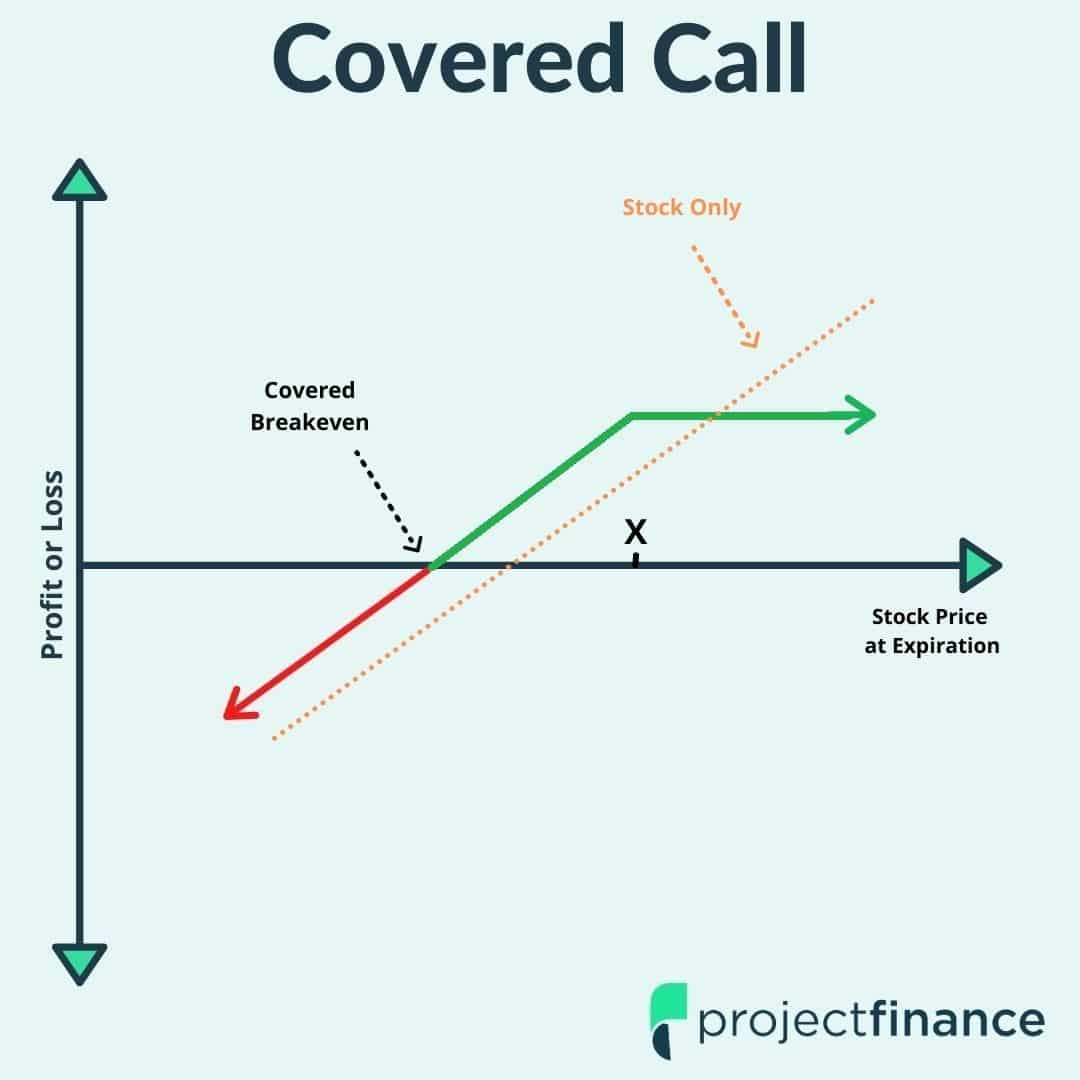

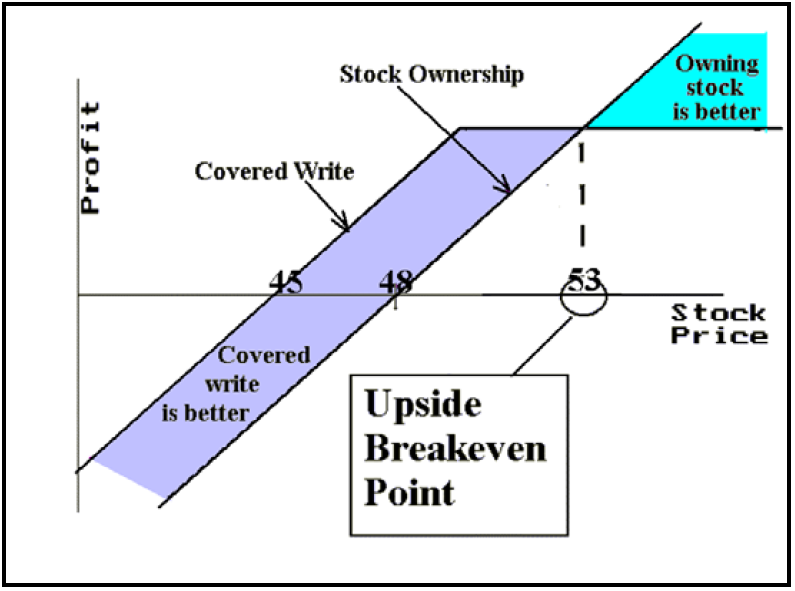

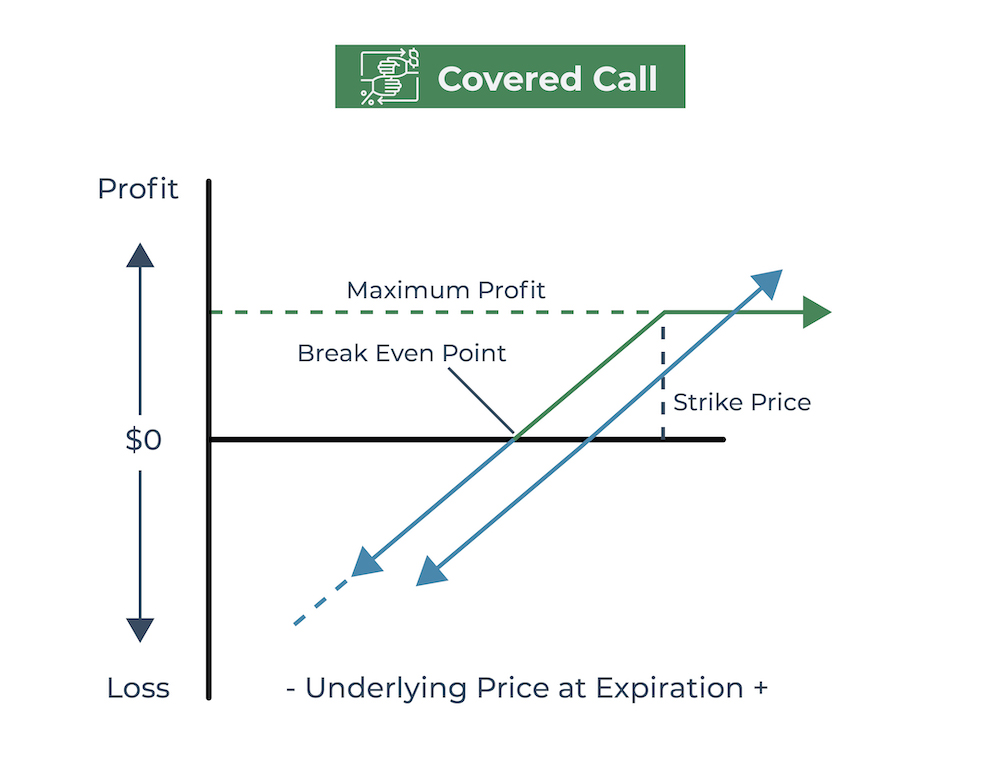

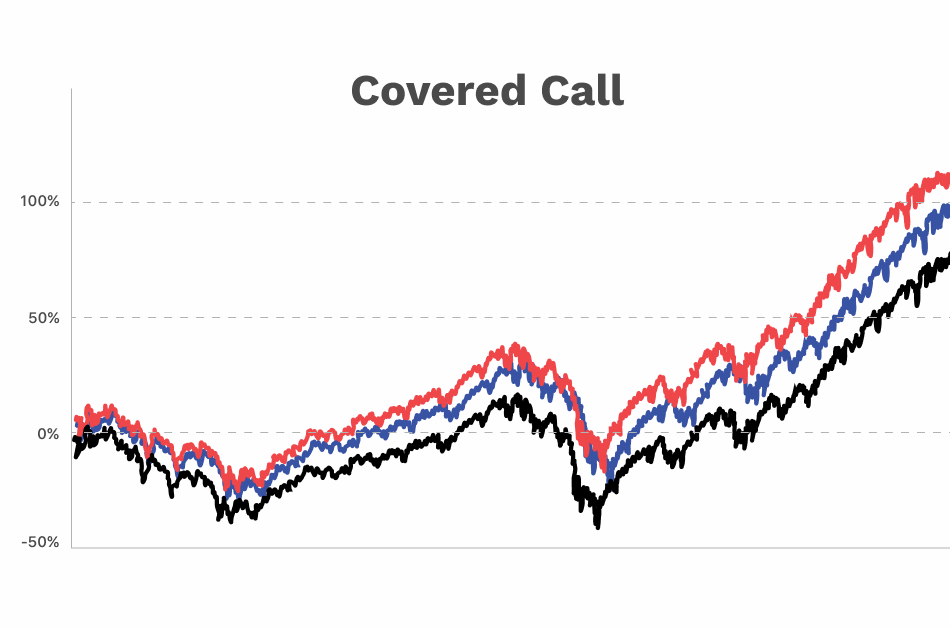

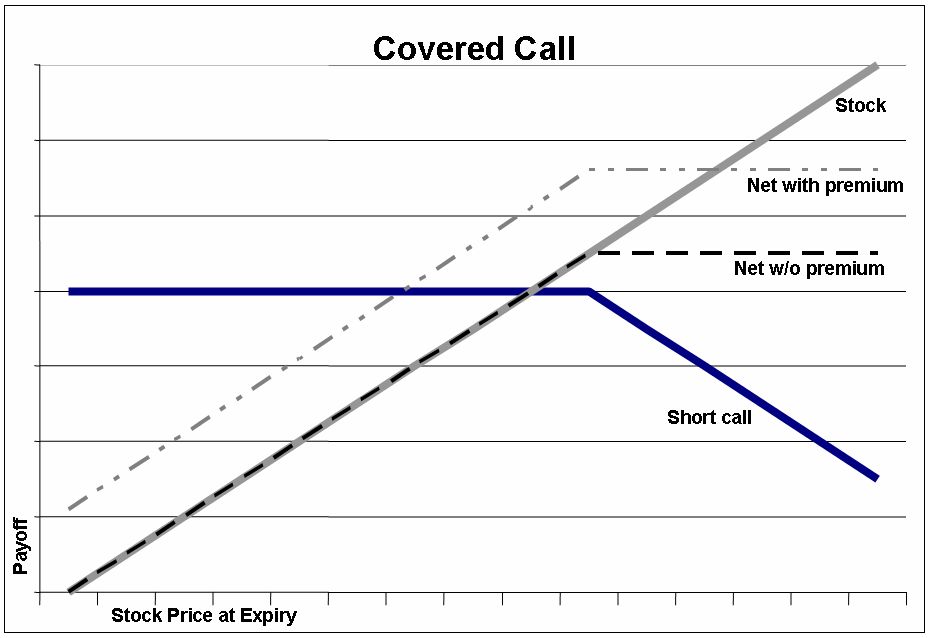

How to buy a covered call. The nature of covered call strategies becomes apparent when computing the annual difference between the covered call index and the s&p 500. In a covered call strategy, you own shares of a stock or etf and sell a call option on those shares.

Share what is a covered call strategy? If the stock is already owned, a call option may be sold at a higher strike. The call premium collected provides an investor with some.

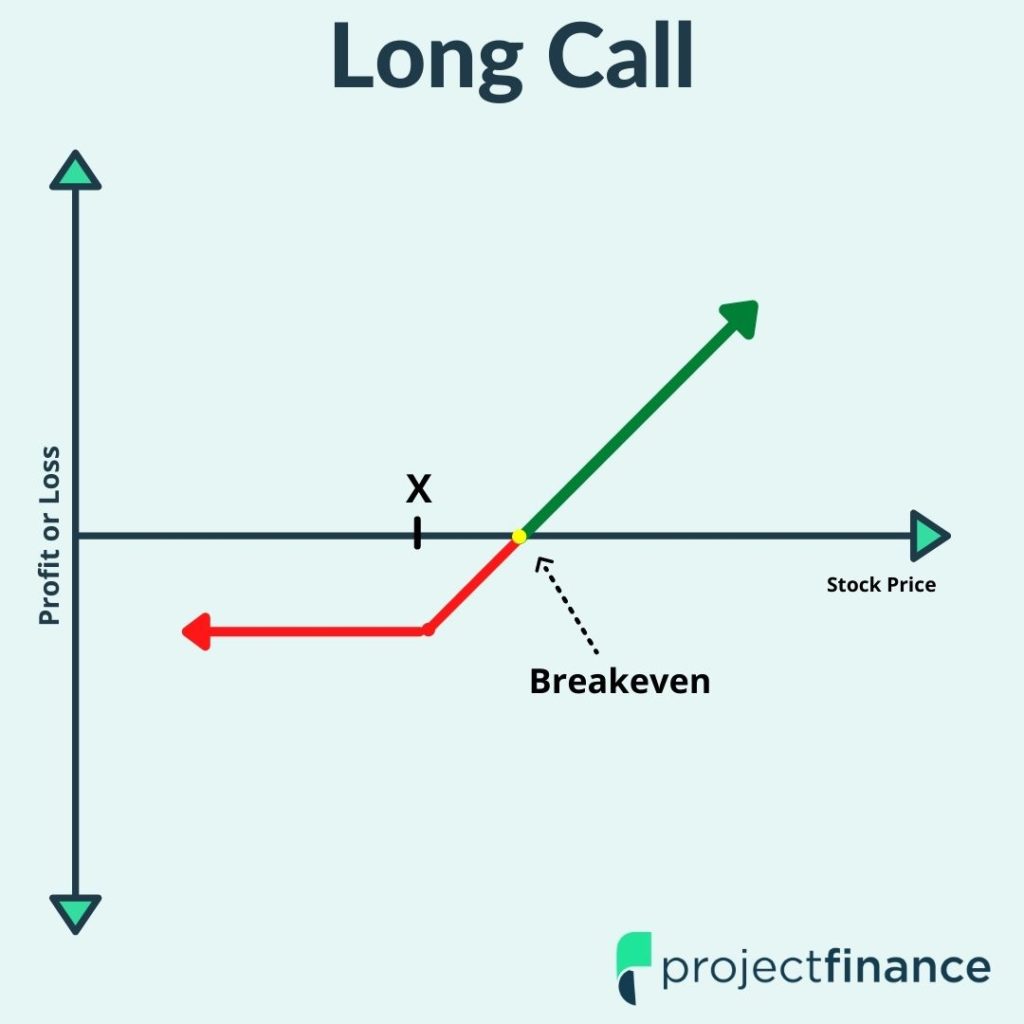

Covered call writing sells this right to someone else in exchange for cash, meaning the buyer of the option gets the right to purchase your security on or before. First, let's nail down a definition. The goal in that case is for the options to expire worthless.

Introduction to rolling and subjective considerations. The term “buy write” describes the action of buying. In a nutshell, a call option is a contract that allows the buyer the right but not the obligation to buy 100 shares of the underlying stock or a futures contract at a certain.

Fairbank said on a call with investors that the deal was expected to be completed in late 2024 or early 2025. Covered calls can also be used to achieve income on the stock above and beyond any dividends. The shares become the linked or.

A covered call requires ownership of at least 100 shares of stock. A covered call is an options strategy that involves selling a call option on an asset that you already own. The call option is ‘covered’ by the existing long position, as should the.

You are entitled to several rights as a stock or futures contract owner, including the right to sell the security at any time for the market price. The main advantage of the covered call. Entering a covered call.

In this strategy, the investor sells (writes) one call option for every.

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

:max_bytes(150000):strip_icc()/Cover-call-ADD-SOURCE-0926fedb5c054b2796cb5f345c173cc7.jpg)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

![What is a covered call? [Infographic] Accessible Investor](https://accessibleinvestor.com/wp-content/uploads/2020/07/What-is-a-covered-call_stock-option-strategies_AccessibleInvestor.com_.png)