Nice Info About How To Reduce Retained Earnings

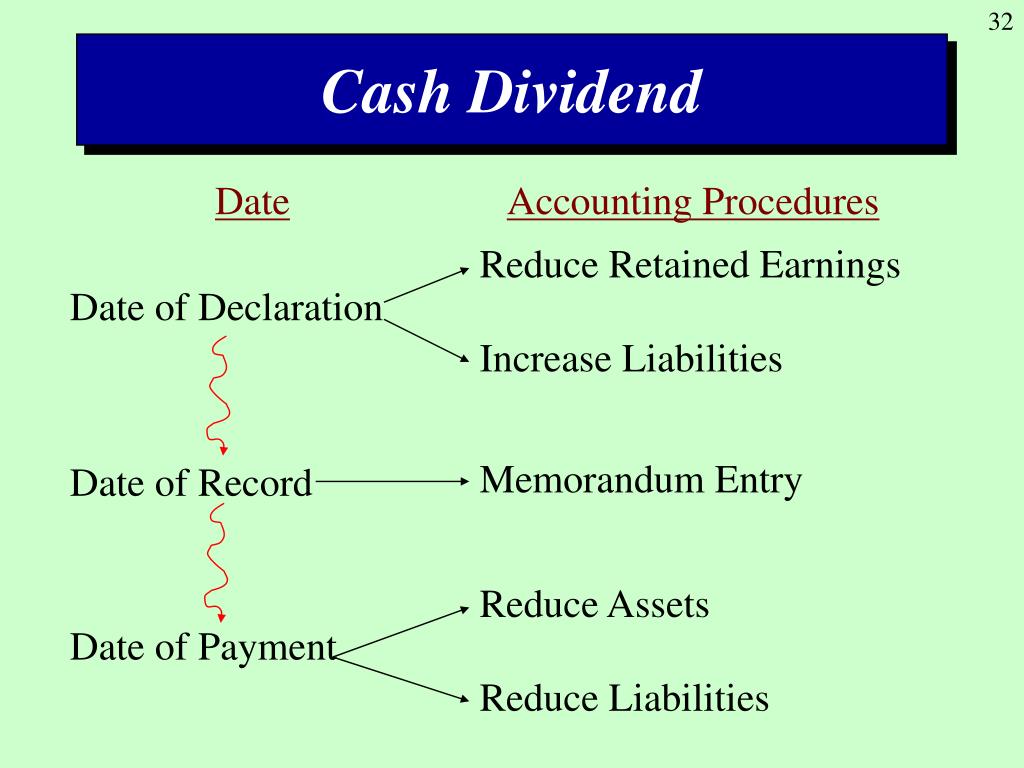

When a company pays dividends to its shareholders, it reduces its retained earnings by the amount of dividends paid.

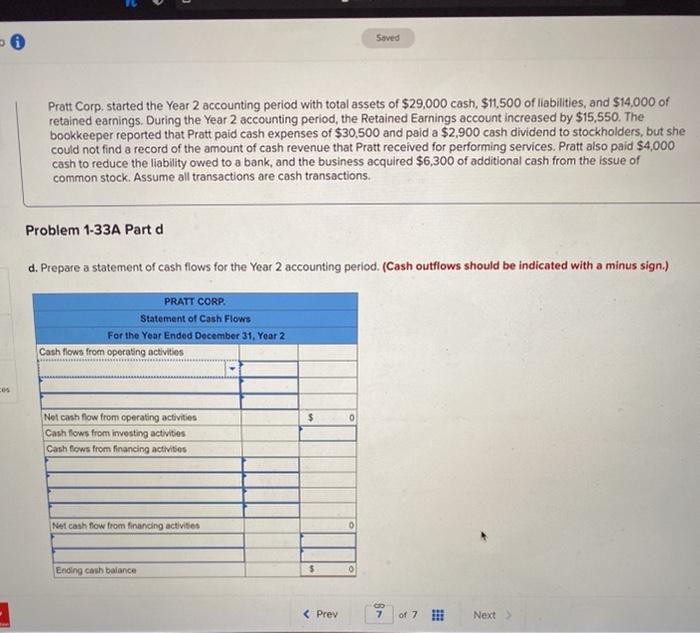

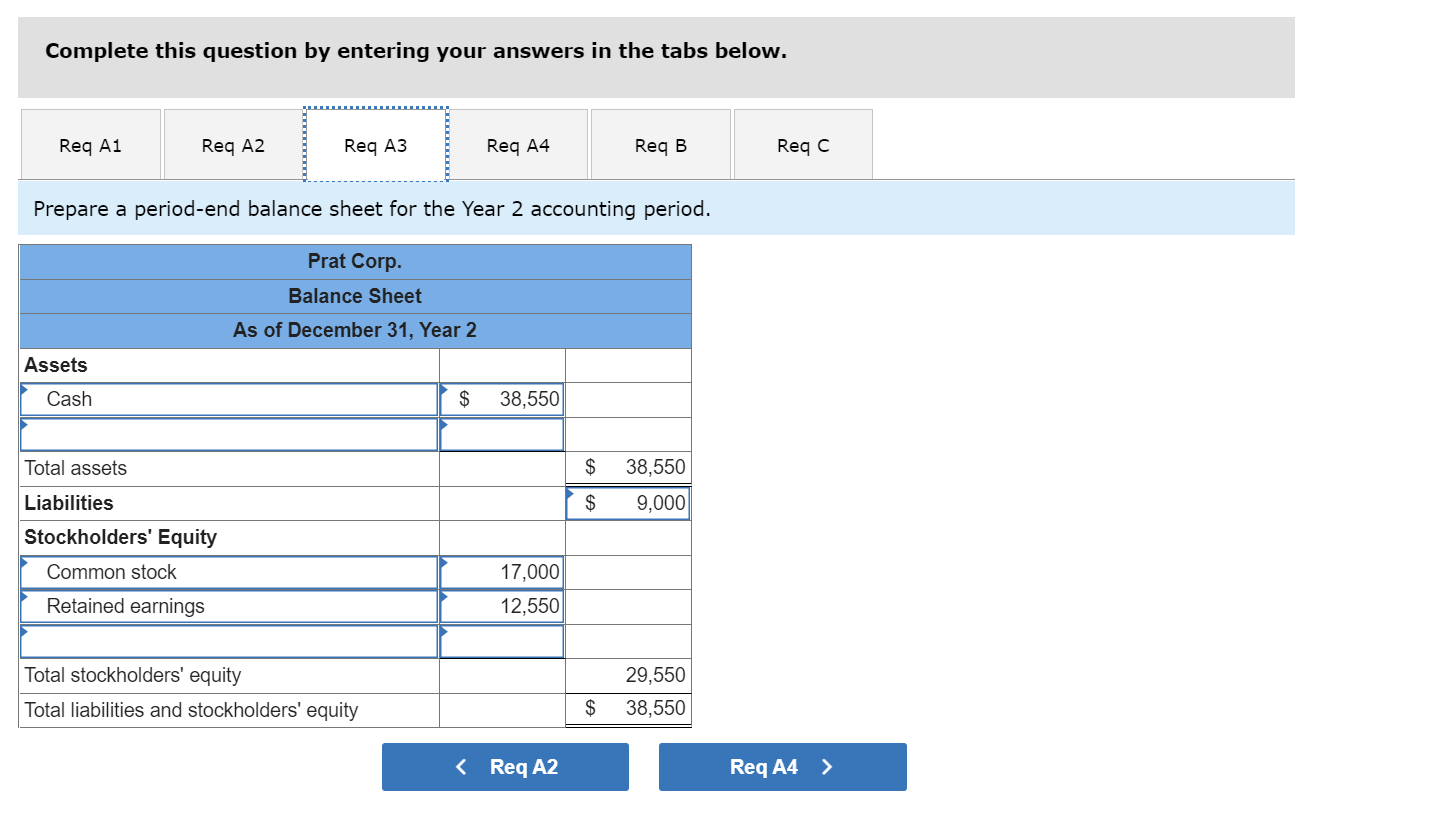

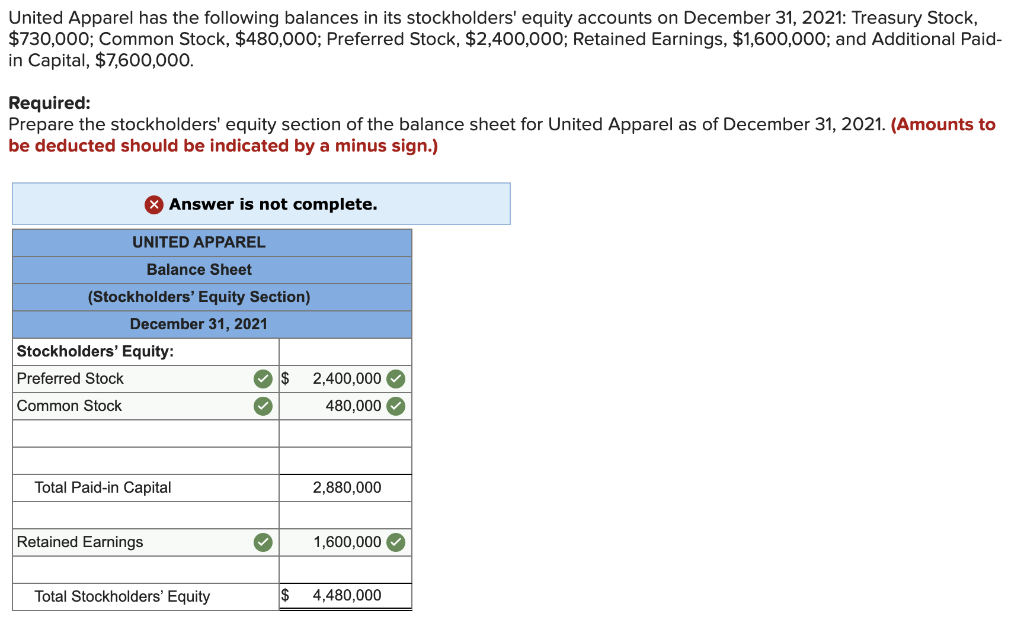

How to reduce retained earnings. Step 1 take out an investment loan. Ending retained earnings = $230,000. Here's how to perform a retained earnings calculation:

Step 3 the corporation pays you an amount as salary. In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax returns to. The more liability a business assumes,.

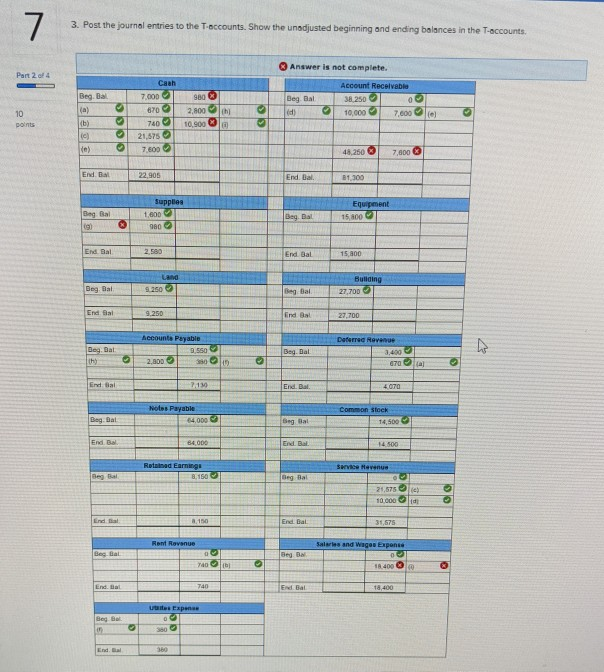

However, there are cases in which businesses must adjust their retained earnings using debit and credit methods while calculating their retained earnings normal balance. Let’s run the retained earnings account quick report to check. While the term may conjure up images of a bunch of suits gathering around a big table to talk about.

Obtain the beginning retained earnings balance you’ll need to access the beginning balance of retained earnings. Retained earnings = beginning retained. This reduction happens because dividends.

Business owners can choose to plough that money back. The journal entry for transferring net income or loss to retained earnings involves debiting the income summary account and crediting (for net income) or debiting (for net. This information is usually found on.

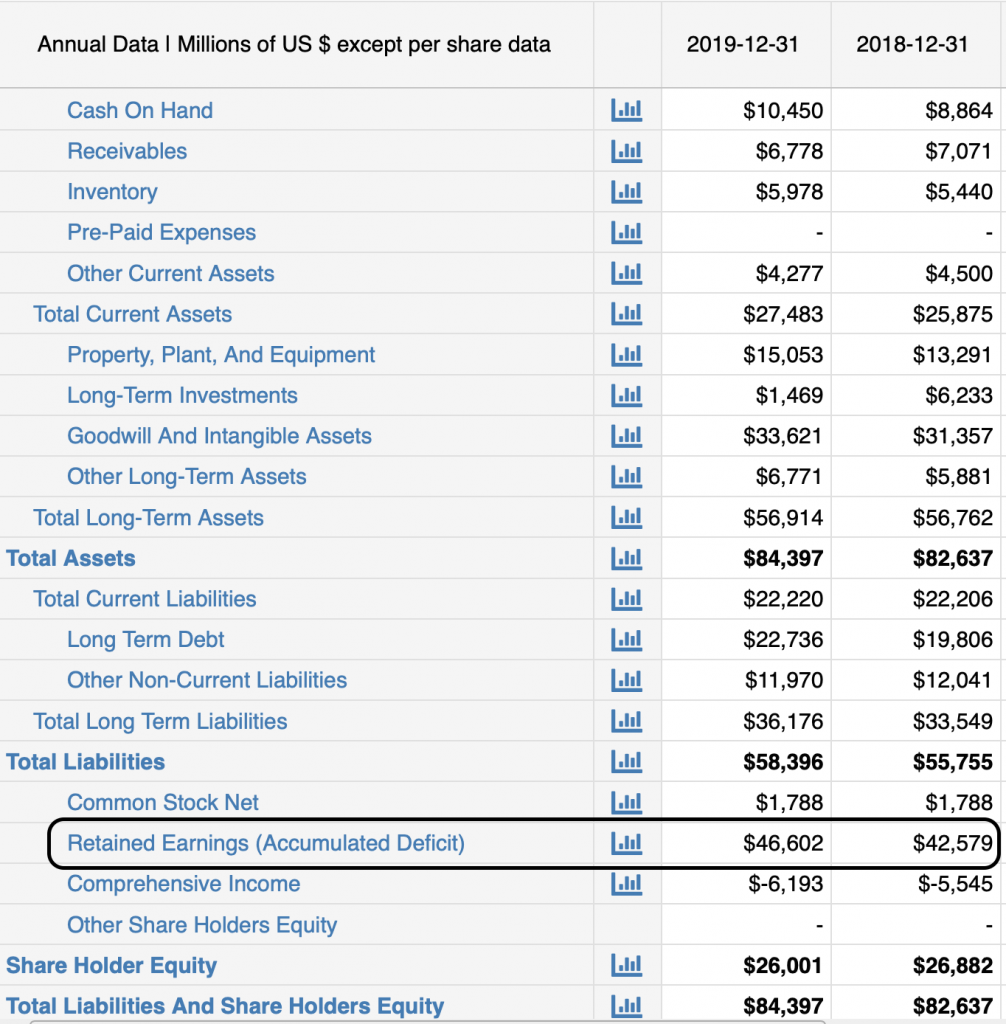

Reducing debt with your retained earnings is an excellent way to get into a healthy financial standing and reduce liabilities. Retained earnings is the amount of accumulated earnings at the end of the period beginning retained earnings refers to the retained earnings balance at the. Net income the company can make the retained earnings journal entry when it has the net income by debiting the income summary account and crediting the retained earnings.

Retain earnings retained earnings are what entity left from its operating profits since the. Net profit is the corresponding entries of retained earnings, and because net profit changes with cycles in sales, expenses, investing, and financing, we can say that retained. I’m here to help and guide you on how to correct your 2021 retained earnings balance.

January 2, 2022 6 minutes to read accounting & taxes retained earnings. Why retained earnings are important for a small business. Advertisement how to calculate retained earnings copied the formula to calculate retained earnings is simple:

Similarly, in case your company incurs a net loss in the current accounting period, it would reduce the balance of retained earnings.