Breathtaking Info About How To Claim A Tax Refund

Refund of a direct debit.

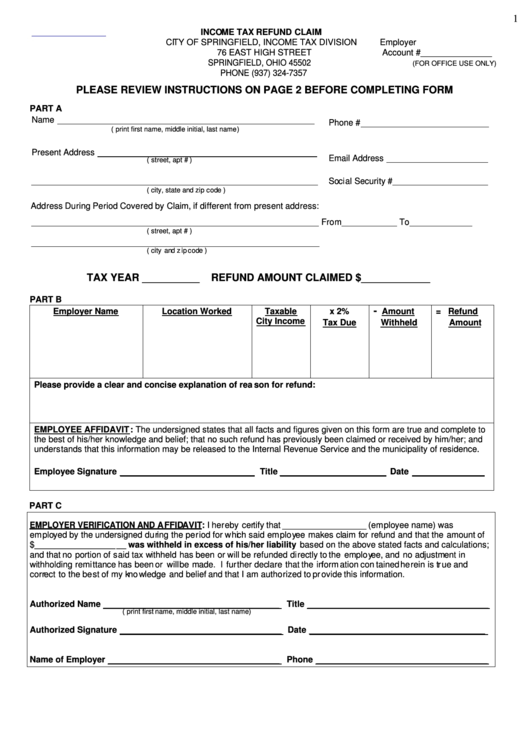

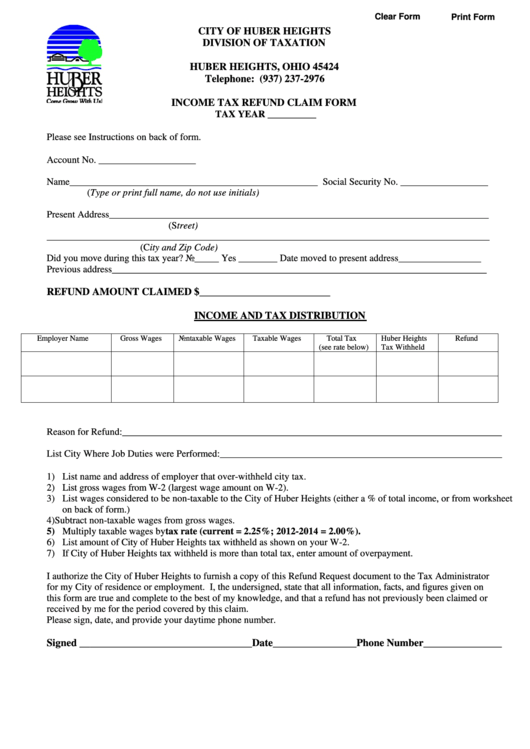

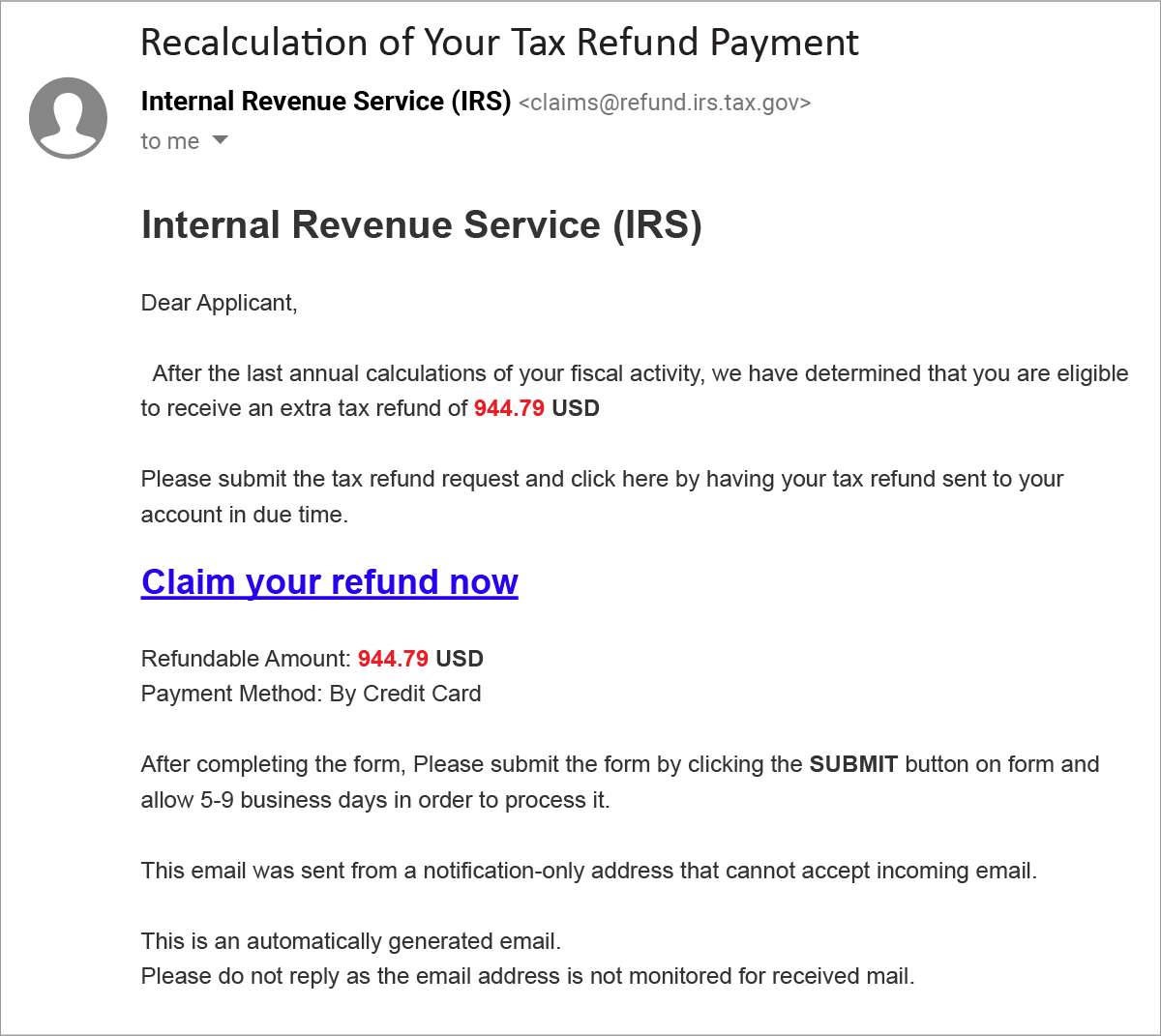

How to claim a tax refund. In most cases, you will get your refund within 30 days of contacting the irs. Fill in and send the form to hmrc or. Check the status of your tax refund.

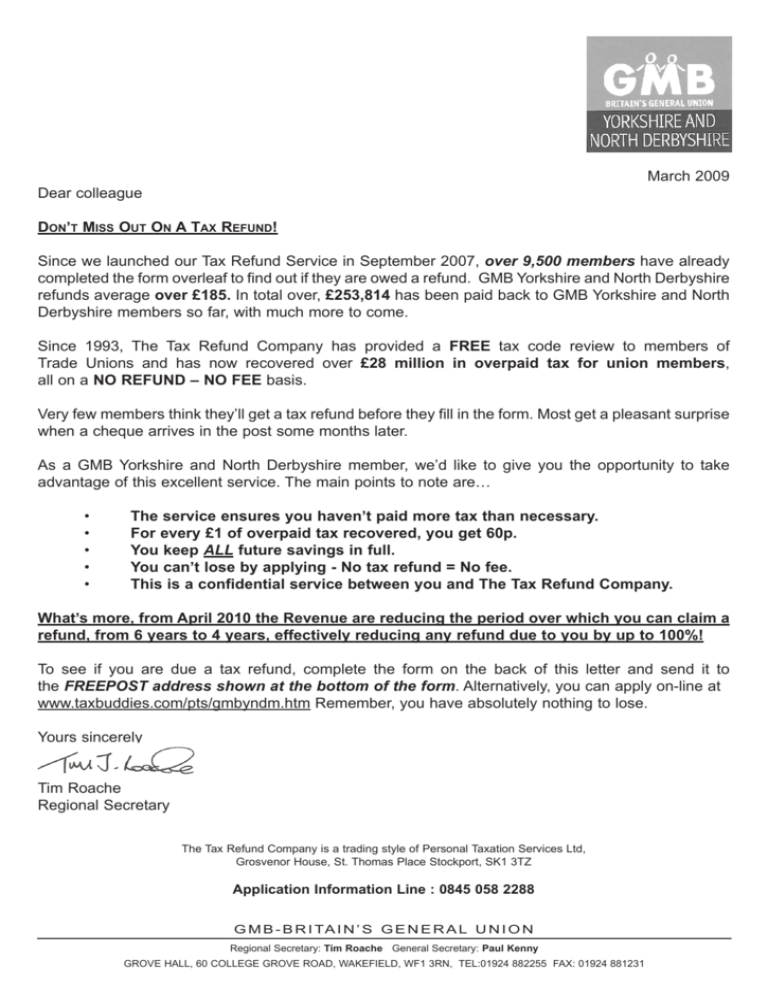

Promoters may claim that newcomers can access benefit and credit payments for periods of time before they arrived in canada. How you file your return can affect when you get your refund. How do i get/when will i receive my refund?

How do i use the hmrc app to claim a tax refund? The rdo where you applied. How can i claim my tax refund?

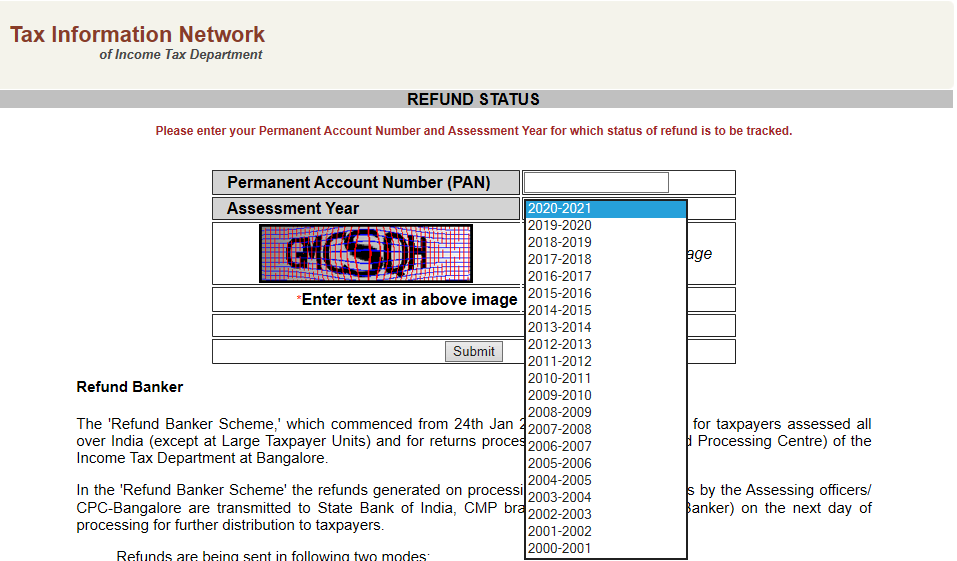

Canadians can begin filing their. Your refund will be automatic if your income is from: Here are the steps to file an income tax return to claim a tax refund from the income tax department.

Learn how to claim a refund in the current tax year if you are not getting taxable benefits or a pension from your employer and you've not started a new job. Go to the get refund status page on the irs website, enter your personal data then press submit. How to claim tds refund when the tax deducted does not match your actual tax payable, you can calculate your taxable income and taxes, file an income tax.

Your eligibility for a tax refund depends on factors like the amount of tax your employer has withheld and the deductions and refundable tax credits you can. You can also check when you can expect a reply and explore the topic of income tax and. Complete the kra refund form with the relevant information required, bank details where you wish your funds to be sent, and finally the kra refund claim.

As per the income tax act, a person is required to file his/her. 19 is the first day you can file your taxes online and there are some key changes that will affect the tax filings of many people in canada. Your national insurance number (you can find this on your payslip, p60 or tax return) your self assessment unique taxpayer reference.

How to claim a tax refund: Tourists can only claim tax refund for purchases of rm300 or more from the same approved outlet. You can also authorise a representative to claim on your behalf.

Within 90 working days after manual submission;. The cra 's goal is to send you a notice of assessment, as well as any refund, within: How is my refund calculated?

Where to check if your tax code is correct and when hmrc will pay you a rebate explained you can check your tax code by using your. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. Hmrcgovuk 70k subscribers subscribe subscribed 496.